123 456 7890

test@example.com

123 456 7890

test@example.com

As we peer into the crystal ball of cryptocurrency investments, one issue comes sharply into focus: the return on investment (ROI) from mining machines in Australia by the year 2025. This domain, teeming with dynamic fluctuations and vibrant potentials, finds itself at the crossroads of technology and finance. With Bitcoin, Ethereum, and the ever-popular Dogecoin leading the charge, the path of mining and hosting services promises both challenges and lucrative horizons for savvy investors.

The landscape of cryptocurrencies is defined by its innovation, and at the heart of this revolution lies the allure of mining. Mining machines—those robust entities designed to perform the complex calculations that validate and secure transactions—are the backbone of the cryptocurrency economy. However, as we approach 2025, the question arises: what does the ROI of these machines look like within the Australian context? The answer is steeped in both opportunity and risk, hinging on factors such as energy costs, technological advancements, and market dynamics.

Consider Bitcoin, the flagship of cryptocurrencies. Mining Bitcoin is akin to mining gold; it requires immense energy and cutting-edge hardware. With the increased competitiveness in this field, many prospective miners are exploring hosting options. Companies specializing in mining machine hosting provide a unique solution, offering state-of-the-art facilities to ensure optimized performance while alleviating the burden of setup and maintenance. This trend is likely to shape the Australian market significantly.

Ethereum, as well, has been a trendsetter in its move towards proof-of-stake systems. While mining may take a back seat in the face of such changes, the demand for miners ready to transition will remain. This transition not only emphasizes the importance of resilient mining hardware but also highlights the necessity of adaptability within the mining community. Investors would do well to remain flexible, opting for machines that guarantee compatibility with evolving technology.

Amidst all this, Dogecoin stands as an intriguing case study. Initially borne out of a meme, it has had its share of whimsy and volatility. Yet, for individuals willing to venture into mining Dogecoin, the equipment tends to be less demanding, making it a popular choice for newer miners. Its accessibility suggests a democratization of mining that can be appealing, especially to those embarking on their crypto adventure in Australia.

As we venture deeper into the ROI discussion, let us consider the regulatory environment. Australia has been proactive in establishing frameworks for cryptocurrencies, ensuring compliance while fostering growth. However, potential miners must navigate this landscape judiciously. The cost of electricity, regulatory implications, and local economic conditions can greatly impact earnings from mining endeavors. With fluctuating energy prices and potential changes in tax legislations, the overall landscape presents both challenges and opportunities.

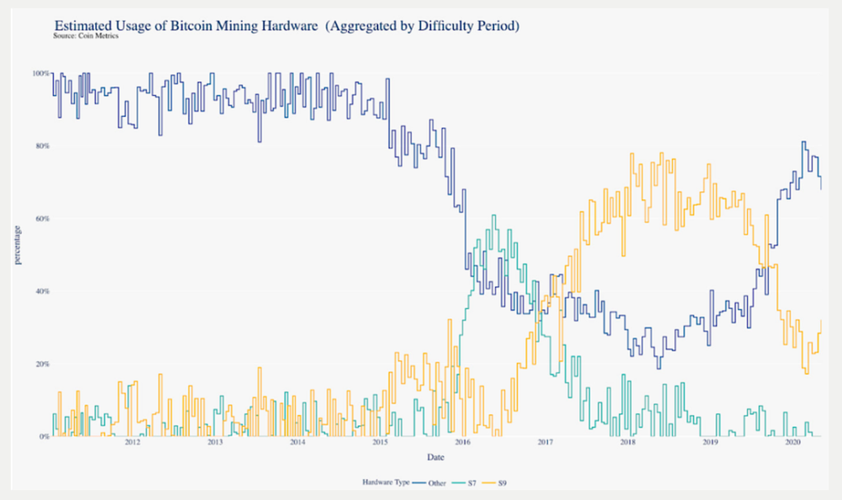

When evaluating the ROI, one must also consider the technological advancements that continuously redefine performance metrics. The introduction of specialized ASIC miners has significantly boosted the efficiency of mining operations. These machines, tailored specifically for mining tasks, outpace traditional models in terms of hashing power and energy consumption. Keeping abreast of these developments will be essential for ensuring long-term profitability.

Australian mining farms are increasingly looking towards renewable energy sources to mitigate electricity costs and enhance profitability. By using solar panels, wind turbines, and other sustainable methods, miners can reduce operational expenses significantly. The dual investment in renewable energy and mining capacity could yield substantial returns, making this a fascinating area for investors to watch and assess moving forward.

As we approach 2025, it’s imperative for investors to build a portfolio that reflects the multifaceted nature of the cryptocurrency landscape. A diversified approach, spanning various cryptocurrencies and mining strategies, will likely provide a cushion against volatility. The decision to invest in mining machines—whether for Bitcoin, Ethereum, or Dogecoin—should be tempered by a thorough analysis of market trends, technological shifts, and regulatory changes.

In conclusion, the Australian mining machine market is poised for a transformative journey towards 2025. For investors willing to navigate the complexities of this evolving landscape, the potential rewards can be substantial. As the dynamics of cryptocurrencies and their associated mining systems continue to unfold, maintaining an adaptive strategy will be essential to securing favorable returns on investment in this electrifying sector.

Leave a Reply