123 456 7890

test@example.com

123 456 7890

test@example.com

The United Kingdom, though not traditionally known as a cryptocurrency mining powerhouse, presents unique opportunities for those looking to delve into the digital gold rush. Setting up a mining operation, however, necessitates careful planning and, crucially, acquiring the right equipment. This step-by-step guide will navigate you through procuring top-tier mining equipment in the UK, from initial research to final installation.

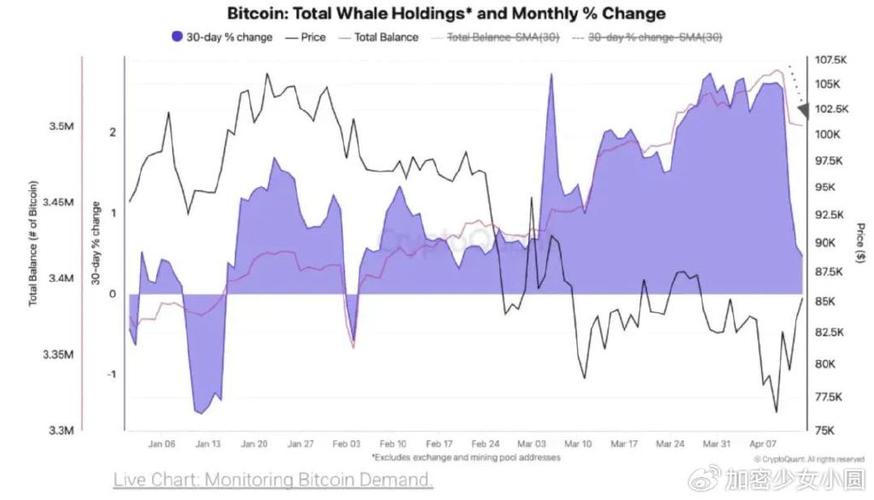

First, understand your objectives. Are you aiming to mine Bitcoin (BTC), Ethereum (ETH), or perhaps a less mainstream cryptocurrency like Dogecoin (DOGE)? Each currency utilizes different algorithms, directly impacting the type of mining hardware required. Bitcoin, for instance, relies heavily on ASIC (Application-Specific Integrated Circuit) miners, specialized machines designed solely for mining Bitcoin. Ethereum, on the other hand, has transitioned to Proof-of-Stake, rendering GPU (Graphics Processing Unit) mining largely obsolete for the main chain. Dogecoin, being Scrypt-based, can be mined with ASICs, although profitability can fluctuate dramatically. Thorough research into the specific cryptocurrency you intend to mine is paramount. Consider factors like network difficulty, block reward, and energy consumption of potential hardware.

Next, define your budget. Mining equipment can range from a few hundred pounds for a single GPU to tens of thousands for a high-end ASIC miner. Calculate your potential return on investment (ROI) by factoring in electricity costs, hardware depreciation, and the fluctuating value of the cryptocurrency you’re mining. Remember that the crypto market is volatile, and profitability is not guaranteed. Overspending on equipment can quickly lead to losses if the market takes a downturn.

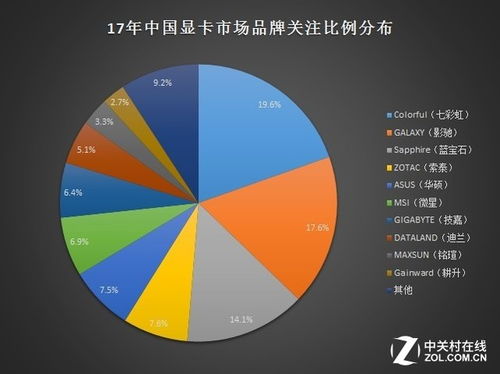

Once you’ve determined your target cryptocurrency and budget, it’s time to research available hardware. Numerous manufacturers produce mining equipment, each with varying specifications and price points. Reputable brands include Bitmain, MicroBT, and Canaan for ASICs, and Nvidia and AMD for GPUs (though, as mentioned, GPU mining for Ethereum’s main chain is no longer viable). Read reviews, compare specifications, and consider the warranty offered by the manufacturer or reseller. Online forums and communities dedicated to cryptocurrency mining can provide valuable insights and user feedback. Be wary of unverified sources and prioritize reputable dealers.

Sourcing your equipment is the next critical step. While ordering directly from manufacturers can sometimes offer cost savings, it often involves dealing with international shipping, customs duties, and potentially longer lead times. Purchasing from UK-based resellers can provide faster delivery, local support, and easier warranty claims. However, compare prices carefully, as resellers may charge a premium for their services. Ensure the reseller is reputable and authorized to sell the equipment. Verify their return policy and warranty terms before making a purchase. Consider attending industry events or trade shows, which can provide opportunities to meet with manufacturers and resellers in person and negotiate deals.

Consider the implications of mining machine hosting. If you lack the space, infrastructure, or technical expertise to operate mining equipment at home, consider a mining hosting service. These services provide secure, climate-controlled facilities with reliable power and internet connectivity. They handle the maintenance and management of your equipment, allowing you to focus on monitoring your earnings. However, hosting services charge fees, which will impact your overall profitability. Research different hosting providers, compare their pricing, security measures, and uptime guarantees. Visit the facility if possible to assess its suitability and ensure it meets your requirements.

Before finalizing your purchase, address the logistical aspects. Mining equipment, particularly ASICs, can be power-hungry and generate significant heat. Ensure your electrical infrastructure can handle the load and that you have adequate cooling to prevent overheating. Consult with a qualified electrician to assess your power capacity and recommend any necessary upgrades. Consider investing in noise reduction measures, as mining equipment can be quite loud. Furthermore, familiarize yourself with UK regulations regarding cryptocurrency mining, including tax implications and environmental considerations. While specific regulations are still evolving, it’s essential to operate within the legal framework.

Once you’ve received your equipment, follow the manufacturer’s instructions carefully for setup and configuration. Join online mining pools to increase your chances of earning rewards. Monitor your equipment’s performance closely and adjust settings as needed to optimize efficiency and profitability. Regularly update firmware and software to ensure optimal performance and security. Stay informed about the latest developments in the cryptocurrency market and adapt your strategy as necessary.

Remember, procuring top-tier mining equipment is just the first step in a potentially long and complex journey. Success in cryptocurrency mining requires ongoing effort, research, and adaptation. By following this step-by-step guide, you can increase your chances of building a profitable and sustainable mining operation in the UK.

Finally, don’t forget security. Protect your mining rig and digital wallet with strong passwords and two-factor authentication. Keep your software updated to prevent vulnerabilities. Be wary of phishing scams and other online threats. Regularly back up your wallet and keep your private keys secure. Mining profitability is heavily reliant on security.

Mining, particularly Bitcoin mining, contributes to the security of the blockchain network. Miners verify and add new transactions to the public ledger, preventing double-spending and ensuring the integrity of the network. The decentralized nature of mining makes it resistant to censorship and control by any single entity. By participating in mining, you are contributing to the resilience and security of the cryptocurrency ecosystem. Always remember the inherent risks and rewards of this endeavor.

Leave a Reply